The United States agricultural trade deficit is projected to increase once again to $32 billion in fiscal year 2024, an increase of $1.5 billion from the February projection, according to…

Russian War Amplifies Agricultural Market Dynamics in India, Ukraine, U.S., and Indonesia

India

Reuters writers Rajendra Jadhav and Mayank Bhardwaj reported today that, “But a rare confluence of high international prices, consecutive record crops, a weaker rupee against the dollar and improved internal logistics have made [wheat] shipments from India attractive.

“‘This is a golden opportunity for India to export its surpluses,’ said Nitin Gupta, a vice president at food and agri-business Olam Agro India.

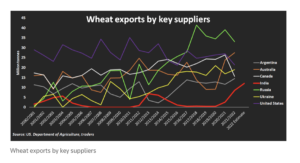

“For international wheat markets, India’s sales are helping offset a supply shortfall resulting from Ukraine-driven disruptions in the Black Sea region, crop cuts in Canada and quality downgrades in Australia.”

The Reuters article pointed out that, “Following a flurry of export deals signed in February and March, India’s wheat shipments touched a record 7.85 million tonnes in the fiscal year to March – up 275% from the previous year.

“Exports could jump to 12 million tonnes in the 2022-23 fiscal year, traders said, making it a serious player in global markets.”

And earlier this week, Bloomberg writers Pratik Parija and Bibhudatta Pradhan reported that, “India will increase subsidies on fertilizers, including potash and di-ammonium phosphate, to cushion farmers from a rally in prices of soil nutrients.”

However, Associated Press writer Aniruddha Ghosal reported today that, “An unusually early, record-shattering heat wave in India has reduced wheat yields, raising questions about how the country will balance its domestic needs with ambitions to increase exports and make up for shortfalls due to Russia’s war in Ukraine.”

The AP article explained that, “Even though it is the world’s second-largest producer of wheat, India exports only a small fraction of its harvest. It had been looking to capitalize on the global disruption to wheat supplies from Russia’s war in Ukraine and find new markets for its wheat in Europe, Africa, and Asia.

“That looks uncertain given the tricky balance the government must maintain between demand and supply. It needs about 25 million tons (27.5 million U.S. tons) of wheat for the vast food welfare program that usually feeds more than 80 million people.”

New York Times writers Hari Kumar and Mike Ives reported yesterday that, “The extreme heat poses a problem for agriculture, a primary source of income for hundreds of millions of people across the subcontinent. In India, wheat farmers have been saying for weeks that high temperatures were damaging their yields.”

Ukraine

Alistair MacDonald reported in today’s Wall Street Journal that, “Russian forces have riddled Ukrainian fields with mines and destroyed equipment in areas they once occupied, in what returning farmers and the Kyiv government allege is a campaign by Moscow to hobble the country’s agricultural industry.”

The extent of damage to some farms, together with port disruption and a shortage of fertilizer, demonstrates how the war’s impact on Ukraine’s agriculture industry could extend well into next year.

“The Ukrainian government estimates that mines are present in around 30% of farm fields in areas around Kyiv previously occupied by the Russians,” the Journal article said.

Meanwhile, Reuters writer Pavel Polityuk reported this week that, “Russia launched two missile strikes and damaged a strategic bridge in Ukraine’s Odesa region, state railways and local officials said on Wednesday, an event that could affect Ukrainian plans to expand exports through Danube ports.”

“Ukrainian agriculture and transport officials have said the country is seeking to boost the export capacity of Danube river ports which allow grain to be shipped through the Danube to Romanian Black Sea ports.”

And Reuters writer Natalia Zinets reported yesterday that, “Ukraine accused Russia on Thursday of stealing grain in territory it has occupied, an act which it said increased the threat to global food security posed by disruptions to spring sowing and the blocking of Ukrainian ports during the war.”

United States

Reuters writers Leah Douglas and P.j. Huffstutter reported yesterday that, “The Biden administration is asking Congress to approve $500 million for the farm sector, in a bid to woo U.S. wheat producers to double-crop their fields, and boost how much the federal government will spend on short-term loans to farmers who grow certain food crops.

“The request is part of President Joe Biden’s broader $33 billion request on Thursday to lawmakers to support Ukraine, a dramatic escalation of U.S. funding for the war with Russia.”

The Reuters article noted that, “The request includes about $100 million to pay for a $10 per acre incentive to farmers – paid through crop insurance premiums – for a soybean crop planted after a winter wheat crop in 2023, the official said.”

Ryan Dezember reported in today’s Wall Street Journal that, “The price of soybeans, which are fed to cows, chicken and salmon and crushed into oils, has gained 26% so far this year. Futures are trading above $17 a bushel for the first time since a hot, dry summer baked American farms and ruined crops in 2012. Until recently, that drought a decade ago was the only time that corn cost more than $8 a bushel. Corn futures, up 37% this year, traded as high as $8.24 on Thursday, about 15 cents shy of the all-time high.”

Bloomberg writers Kim Chipman and Megan Durisin reported yesterday that, “Soybean oil once again reached the loftiest price ever while corn approached a decade high as war in Ukraine chokes global supplies of grains and vegetable oils.”

Indonesia

Also yesterday, Bloomberg writer Eko Listiyorini reported that, “Indonesia, which ships about a third of the world’s edible oil cargoes, has just imposed a sweeping ban on palm oil exports to protect its domestic market at a time of rampant global inflation — one of the most dramatic examples of food protectionism in recent history.”

Reuters writer Bernadette Christina reported today that, “The [Indonesian] policy changes have sent shockwaves through global edible oil markets, which have also been on edge after the war in Ukraine took out a big chunk of the supply of edible oils.

“Indonesian officials have pledged to remove the export ban once bulk cooking oil prices return to 14,000 rupiah a litre, though some see a risk of the policy being undermined by hoarding if international prices keep rising.”

A Reuters article yesterday by Bernadette Christina and Fransiska Nangoy reported that, “Indonesia should be able to tackle its cooking oil shortage in the next few weeks and lift an export ban on palm oil and its refined products in May, an industry body said on Thursday, a day after a last-minute policy U-turn sparked more alarm for markets.”