Modern avionics units differ greatly from their predecessors. Digitalisation has allowed avionics equipment to become smaller, lighter and more software-driven, and for units and systems to require less power. How have the changes driven by digitalisation affected the avionics repair, testing and fault-finding business? Chris Kjelgaard reports

This piece first appeared in the May 2021 issue of MRO management which you can read here

The avionics repair, testing and fault-finding business is experiencing profound but gradual change as the aviation industry – known for its long business cycles – is being changed by its adoption of digitalised electronics, the technological movement which has transformed the much faster-moving consumer electronics industry over the past 25 years.

“Aviation is poised to be the next big industry in digitalisation, and I can see the pace [of adoption] increasing,” says Collins Aerospace’s vice-president and general manager of avionics service and support Craig Bries. This major sea-change is having a particularly marked effect on the aerospace industrial sector devoted to avionics, the instruments and systems by which aircraft are flown and navigated by pilots and by which air traffic controllers on the ground are able to communicate with and receive information from aircraft in the air.

Avionics units and systems are being transformed by aviation’s now-ubiquitous adoption of digitalised electronics technology, according to Vipul Gupta, vice president and general manager of Honeywell Aerospace’s Avionics Business Enterprise. “With time, avionics are getting smaller in terms of size, weight and power [requirements], and there is a lot more complexity in a single card,” he says.

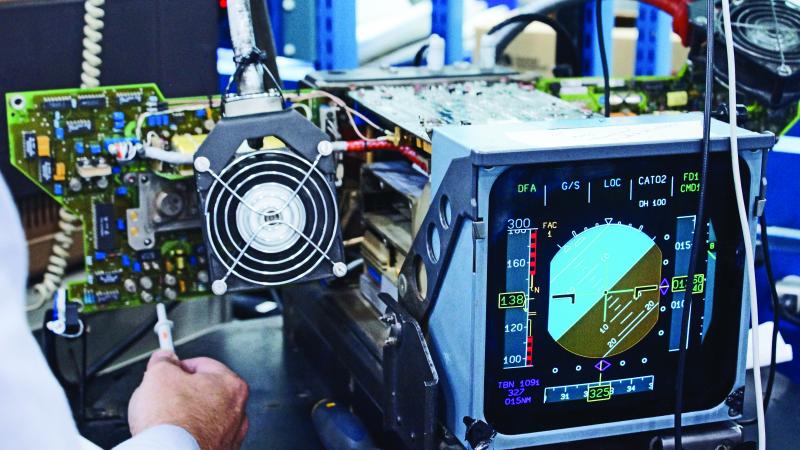

A good example is Honeywell’s ‘IntuVue RDR-7000’ weather radar, which replaces the moving waveguides and magnetron-based transmitters of previous generations of weather radars with entirely solid-state transmitters which use pulsed compression. The RDR-7000 (pictured left) is lighter and more reliable and uses less power than its predecessors; and because its weather-sensing capabilities are entirely software-derived, operators using the RDR-7000 can add advanced features at any time, among them turbulence detection, advanced mapping, target detection, sensing of additional hazards such as lightning and hail detection and predictive windshear forecasting.

Repair and testing of avionics units and systems – including fault-finding – has always represented an important part of the wider avionics business. Increasing digitalisation of avionics has several major implications for the avionics repair business. One, says Jon Hobgood, vice-president of engineering in Honeywell Aerospace’s integrated supply chain, is that because the increasingly miniaturised equipment requires less power than did previous avionics units, “you can cram more electronics into one box, so testing and design gets more complicated”.

Additionally, says Hobgood, modern digital avionics units “are all starting to work in a distributed network, so [individual] avionics are communicating with each other more than in the past. So testing [of each individual unit] is more complex in terms of how it communicates with other units in the network.”

Avionics and integrated circuits

New avionics units and systems today rely much less on printed circuit boards (PCBs) than did the preceding generation and more on integrated circuits composed of individual silicon chips, says Allan Pennycuick, vice-president of operations for independent component and avionics repair company AJW Technique (pictured below). These integrated circuits all have their own built-in software, which provides their functionality and control. Accordingly, administering software upgrades is becoming a very important part of the avionics repair and testing process.

Increasingly, this task is replacing the traditional one of calibrating and tuning avionics units in the shop for repair, according to Lee Moore, director of avionics product support for Garmin International. “The lack of mechanical or electro-mechanical components in modern avionics has eliminated the need for tuning or adjustments,” he says. “Many tuning, calibration or alignment activities are accomplished with software and often with no additional hardware or test equipment required.”

Moore notes that the increasingly digital nature of avionics systems isn’t the only factor affecting the overall repair picture for them. “The advent of surface-mount and solid-state componentry has nearly eliminated field-repair of most line replaceable units,” he says. “Most avionics shops are not equipped or staffed to handle component-level repair for surface-mounted components. In the case of Garmin equipment, return-to-service requirements, in most cases, necessitate the use of highly specialised and sophisticated automated test equipment and software.”

Gupta says the increasing use of chip-based circuits, which are combined within avionics units into circuit card assemblies (CCAs), means that “a lot more automated testing, using the same test procedures as in production” needs to be performed on such units. It also means that, rather than taking time to fault-find every electrical piece-part and then replacing a particular piece-part within the avionics unit being repaired, “it can be cheaper to replace the entire CCA”.

He says this practice is likely to become more prevalent in the future, as continuing digitalisation and miniaturisation of avionics equipment leads to the creation of an entire “system on a chip”, and as testing of the embedded software within such units grows more complex.

Yet another consequence of the increasingly digital and solid-state nature of modern avionics systems is that the electrical parts within each unit – indeed, within each individual circuit card – have to work very reliably. If they don’t, then an entire CCA might have to be replaced and, essentially, thrown away as scrap. While this might be cheaper than performing extensive fault-finding and selective repair, it is nevertheless an expensive proposition. Accordingly, says Hobgood, “you’ve got to pick the right components” from which to build up each CCA, “so there is a lot of demand in the market for some electrical components”.

In many cases, these components are standardised chips and other small electrical parts. According to Pennycuick, these parts form part of the general global supply chain for electrical components and there is a great deal of demand competition for them – not only from other avionics and aerospace manufacturers but also from other industries entirely, such as the automotive and consumer electronics sectors. As a result, says Hobgood, “Honeywell has a lot of component engineers looking at component road-maps” in order to ensure that the company can maintain as reliable a supply of suitable electrical parts as possible.

Testing times

The more digital, miniaturised and embedded software-driven a given piece of avionics equipment is, the more automated and digitally controlled will be the avionics test-bench equipment that is needed to test it for faults and to verify its functioning. For testing during avionics repairs, some avionics manufacturers – such as Collins Aerospace and Garmin International – use proprietary test systems which are the same as those they use to test their new-production avionics units for quality control and functionality.

Other OEMs, and most if not all major third-party avionics repair companies (such as Lufthansa Technik, Delta TechOps, Air France-KLM’s Barfield subsidiary and AJW Technique), use similarly sophisticated equipment made by other companies. The industry standard in non-proprietary automated test equipment is the ‘ATEC 5000’, ‘ATEC 6’ and ‘ATEC 7’ series of automated test benches made by Spherea, a company spun off from Airbus after the aircraft manufacturer had originally developed the ATEC system.

Each ATEC test bench requires specific interface or adaptor units (known as ‘patches’, which have to be procured separately) for each specific item of avionics equipment tested. “More and more we’re seeing large OEMs using ATEC solutions as well,” says Pennycuik. “The trend is to use generic test equipment, along with specific adaptors. I would expect that trend to continue.”

While Collins Aerospace has its own avionics repair-testing standards and proprietary equipment, “just as important is where this is all going – repairing on-wing”, says Bries. “We will be using artificial intelligence and digital tools in the future which will enable entire value chains to better plan and be more prepared” for timely repair of avionics units. Aircraft operators will experience “less disruption” as a result. To that end, Collins Aerospace has formed an internal organisation in which, according to Bries, “we have brought together in one organisation digital scientists, our connectivity products and our aeronautical information network ‘ARINC’. We will put [data] analytics into that, bringing the whole lot – infrastructure, systems and information – into one package,” to bear on the challenge of proactively predicting repair requirements at the level of the individual avionics unit before the need for that repair becomes an aircraft-on-ground emergency.

Repair status

For Garmin (and other OEMs which make modern digital avionics equipment), “software updates and configuration changes, by far, cause the most shop visits outside of hardware upgrades”, according to Moore. But there is still a great deal of work available for third-party facilities and OEMs alike in repairing units installed in long-established commercial and business aircraft families such as all models and generations of the A320, A330, 737, 767 and Cessna Citation lines.

Thousands of these aircraft have slightly less digital, less integrated avionics units and systems and each item of avionics equipment installed on each aircraft has “certain electrical components [which] degrade over time,” says Pennycuick. Active aircraft are constantly exposed to stresses of temperature, pressure and humidity and some electrical parts and connections within avionics units – particularly solder joints – occasionally need repairing or replacing. Hairline cracks are often found within cold solder joints and the need for repairs of such defects has been common since the advent of modern avionics.

Another common type of repair is the need to replace beyond-economic-repair (BER) cathode ray tube (CRT) displays found in the first generation of fly-by-wire and electrically controlled aircraft until the early 2000s. For instance, says Pennycuick, every A320 family aircraft built up until 2003 had ‘FCD-66 CRT’ displays on its flightdeck (after which the FCD-66 was replaced by a liquid crystal display in new-production A320 family jets), but the manufacturers of those displays for Airbus – Thales and its sub-vendor suppliers – stopped making them years ago.

“Repairing them is not economical – you need used serviceable material instead for replacement,” says Pennycuick. If it hadn’t been for the sudden glut of grounded older aircraft that resulted from the Covid-19 pandemic and the availability of many of those aircraft for teardown, replacement of the FCD-66 CRT displays in many still-operational older A320 family aircraft might not be possible now. “They could have had a real supply problem,” he says.

Third-party outlook

Because there are still thousands of commercial and business aircraft flying with units of avionics equipment installed which don’t have integrated chip-based architecture and with flight displays which don’t use LCD or LED technology, “there is no short-term threat to third-party avionics repair shops”, according to Pennycuick. He believes that even the A320neo family and 737 MAX family commercial jets being manufactured today will remain business staples for companies such as AJW Technique for a long time to come.

However, the repair landscape today is very different for AJW Technique and other third-party facilities when it comes to performing work on the avionics for new-generation, highly electric aircraft families such as the 787 (and presumably the 777X), the A350 XWB and the A220, Pennycuick says. In part because repairs to most of those current-production aircraft are still covered by their manufacturers’ warranties and partly because the OEMs making the latest-generation digital avionics units are (in Pennycuick’s view) still holding access to their avionics design and engineering data closely, “the OEMs are really controlling access” to the avionics repair markets for those aircraft. Today, the avionics manufacturers are performing “90 per cent-plus” of all avionics repairs for those types, he estimates.

Eventually the contractual requirements stipulated by aircraft manufacturers to their avionics vendors for the latter to make their design and repair data available to customers for the aircraft should ensure that in the longer term third-party avionics repair companies are able to perform repairs on current-generation, all-digital avionics equipment. Separately, additional pressure from airlines and operators of business aircraft on the avionics OEMs to share that data should speed permeation of the requisite repair knowledge among third-party repair providers.

Another important factor arguing for the longer-term relevance of the third-party shops is that in many cases the OEMs work cooperatively with third-party providers on both a one-off and a continuing-relationship basis, depending on the circumstances of each individual business case for an avionics repair.

“As a component OEM, we’re here to serve the customer,” says Bries. “Our customers desire choice and multiple channels, and we’re willing to work with all” third-party players.

Additionally, says Gupta, while OEMs use their own avionics repair shops, they also make use of third-party repair facilities – often by means of creating licensed repair networks of third-party shops to ensure each of their customers is supported optimally for repairs in terms of turnaround time, cost and convenience, no matter where that customer is located in the world. “We do share some information with those facilities on how to repair our products,” he says. “Aerospace in general [though] is a low-volume repair market, unlike the automotive market.”

As a result, “we often consolidate [specific] repairs into one or two places,” says Gupta. In each case, Honeywell’s arrangements for repairs on a specific product model or type of repair depend on a number of factors. These range from how capital-intensive the investment required is to Honeywell’s contractual obligations with a particular class of customer or an individual customer, and also what specific repair capabilities the company itself has in a given geographical region. In all cases, Honeywell’s focus for deciding its repair arrangements is on what represents the best arrangement for its customers.

As an avionics OEM which does not serve the commercial aviation sector, but is primarily active in serving the business and general aviation markets (and also the military and government sectors), Garmin International has somewhat different considerations regarding its repair arrangements with third-party providers than do Collins and Honeywell.

“We have a small-parts catalogue that allows our global network of about 700 authorised Garmin dealers some replacement of common wear items such as knobs, buttons, switches and batteries and so on,” says Moore. “But, currently, because we use proprietary and highly sophisticated automated testing for return-to-service authorisations, we generally do not support third-party component-level repairs.”

He adds: “Avionics products repaired by Garmin go through a complete refurbishment and re-certification process that, in every case, returns a unit that has been certified to the latest new production standards. Our turnaround times are typically no more than 48 hours from receiving dock to shipping dock. We have two Part 145 repair stations: one in Olathe, Kansas and another in Southampton, UK, and we maintain healthy stocks of newly overhauled (NOH) spares in strategic locations to help us cover the globe with overnight shipping capability for NOH exchanges.”

In the final analysis, says Pennycuick, because the specialised test equipment required costs so much, the repair market for “avionics has always had a bit more of a barrier to entry than hydraulics, for instance”. This should help third-party OEMs remain competitive in a changing market, as should a willingness to work cooperatively on repairs with avionics OEMs when required.

AJW Technique has cooperative working relationships with Honeywell and other OEMs and its arrangements to work on repairs with those companies create “a symbiotic, win-win situation”, says Pennycuick. But it is important to note that AJW Technique is in a position to partner with avionics OEMs on a case-by-case basis because those manufacturers know that the Montreal facility has an industry-wide reputation for high-quality repairs. Not only does AJW Technique repair, test and re-certify avionics units sent to it; it also opens them up and cleans them thoroughly. By doing so it ensures the repaired units it returns to its customers are in as-new condition. “It gives people confidence the unit will have reasonable life [remaining] when AJW Technique re-certifies it,” he says.