Apr-2024

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

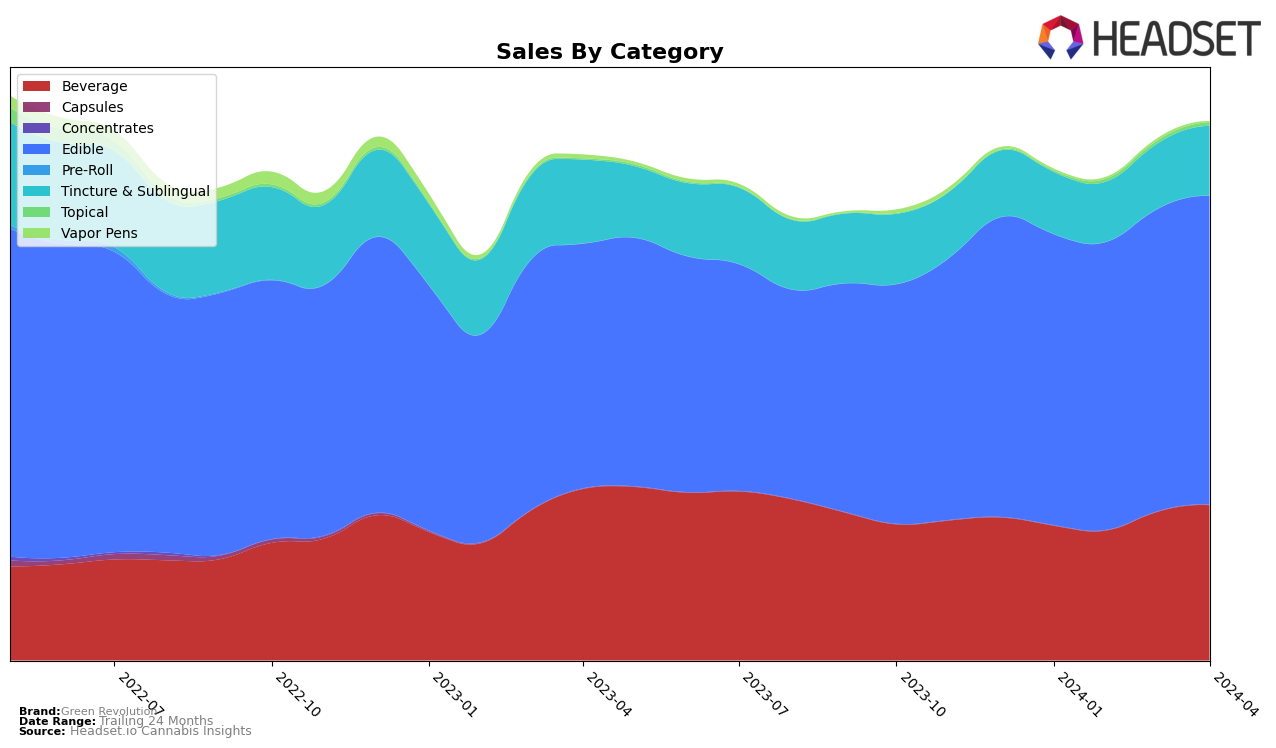

In Washington, Green Revolution has shown remarkable consistency across its product categories, maintaining its rank within the top three for Beverages, Edibles, and Tinctures & Sublinguals from January to April 2024. Notably, in the Edibles category, Green Revolution secured the second rank throughout the observed period, with sales peaking in April at 966,165 dollars, indicating a strong consumer preference and growing market share. Similarly, its performance in the Beverages and Tinctures & Sublingual categories remained steady, holding onto the third and second positions respectively, which reflects a well-established brand presence and loyalty among its consumer base. This consistency is a positive indicator of the brand's stability and appeal in the competitive Washington market.

However, the lack of presence in other states or provinces suggests a focused but potentially limited market reach for Green Revolution. While the brand's stronghold in Washington is evident, expanding its footprint could be an area for growth. The absence from the top 30 in other regions might indicate either a strategic concentration on the Washington market or untapped potential in broader markets. For investors or competitors analyzing market dynamics, Green Revolution's performance highlights a successful penetration in key categories within Washington, but it also opens questions about scalability and diversification of market strategy. Understanding these nuances is crucial for stakeholders looking to gauge the brand's overall market performance and future growth opportunities.

Competitive Landscape

In the competitive landscape of the edible category in Washington, Green Revolution consistently holds the second rank from January to April 2024, showcasing a strong position in the market. Despite its robust standing, Green Revolution trails behind Wyld, which leads the category with significantly higher sales, indicating a substantial gap that Green Revolution would need to bridge to claim the top spot. On the other hand, Green Revolution maintains a lead over its other competitors, such as Craft Elixirs and Hot Sugar, which fluctuate in the third and fourth ranks over these months. This analysis suggests that while Green Revolution has a solid foothold in the Washington edibles market, there is a clear opportunity for growth and potential challenges in further distinguishing itself from both its leading competitor, Wyld, and those trailing behind.

Notable Products

In April 2024, Green Revolution's top-performing product was the Nano Doozies - CBD/CBN/THC 1:1:1 Blue Raspberry Nighttime Gummies 10-Pack, maintaining its number one rank from the previous months with sales reaching 13,765 units. Following closely, the Wildside Chill - THC/CBN 20:1 Blue Raspberry MAX Shot secured the second position, consistently holding this rank across the observed period. The third spot was taken by Wildside Fly Max- CBG/THC 1:1 Sour Green Apple Fast-Acting Shot, showing no change in its ranking since the beginning of the year. Notably, the Wildside Max - CBN/THC 1:2 Pineapple Orange Guava Fast-Acting Shot rose to the fourth position in April, improving from its fifth rank in March. This data indicates a stable consumer preference for Green Revolution's top products, with minimal fluctuations in their rankings over the months.

Top Selling Cannabis Brands